As digital financial services continue to evolve, customer expectations are growing at a faster pace than ever. While fintech companies aim to deliver speed, security, and seamless service, many fall short, leading to customer frustration and churn. Here are four common CX breakdowns that fintechs can’t afford to ignore.

-

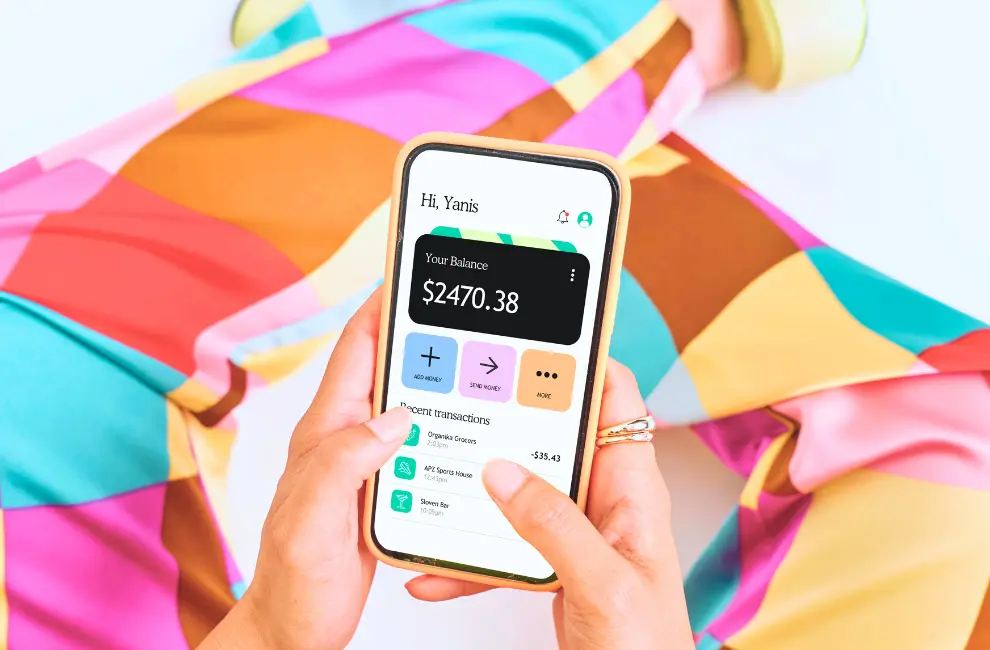

Clunky or Disappointing Digital Experience

Fintech customers expect intuitive, mobile-first platforms that feel effortless to use. But when the experience is slow, confusing, or inconsistent, trust erodes quickly. Industry growth is projected at over 16% annually through 2032, yet “shifts in consumer expectations” remain key obstacles when platforms don’t feel fast or intuitive. Fast loading, simple navigation, and friction-free onboarding aren’t optional, they’re critical.

-

Poor Customer Support: The Human Touch Still Matters

While automation and AI are central to scalability, customers still want to feel understood and valued. Nearly 70% say that they expect digital tools to feel more “human”, and a significant portion would switch providers after a poor support interaction. In moments of confusion or urgency, empathy and responsiveness make all the difference. Pair automation with real-time human support to build loyalty where it counts.

-

Security Lapses & Fraud Erase Trust Instantly

The explosion of digital transactions has made fraud prevention a top priority. Yet customers are quick to leave when security feels reactive or vague. Transparency, communication, and rapid resolution are now just as crucial as back-end security systems themselves. Trust is fragile. Don’t let silence after a breach break it.

-

Regulatory Non-Compliance & System Failures

From delayed updates to system outages, even back-end issues impact the user experience. With increasing scrutiny across financial institutions, companies that don’t embed compliance and stability into their operations risk frustrating users and falling behind. Reliability and compliance aren’t just internal goals; they’re customer-facing values.

Why It Matters, And How CBE Can Help

The stakes are high, and every interaction counts. A single poor experience can cause a customer to leave. Not just your platform, but your brand entirely. That’s where we come in.

CBE Customer Solutions specializes in helping fintech companies create customer experiences that retain users, build trust, and scale efficiently. Our trained customer care teams offer:

- Omnichannel Support that blends speed with empathy

- Fraud Support services that resolve issues quickly and clearly

- Regulatory-Compliant Processes backed by decades of experience in highly regulated industries

- Flexible Staffing Models to help you scale during growth, product launches, or increased demand

- Seamless Integration with your brand tone, values, and digital tools

Whether you’re solving a CX gap or preparing for your next stage of growth, CBE Customer Solutions helps you meet the moment and exceed expectations.